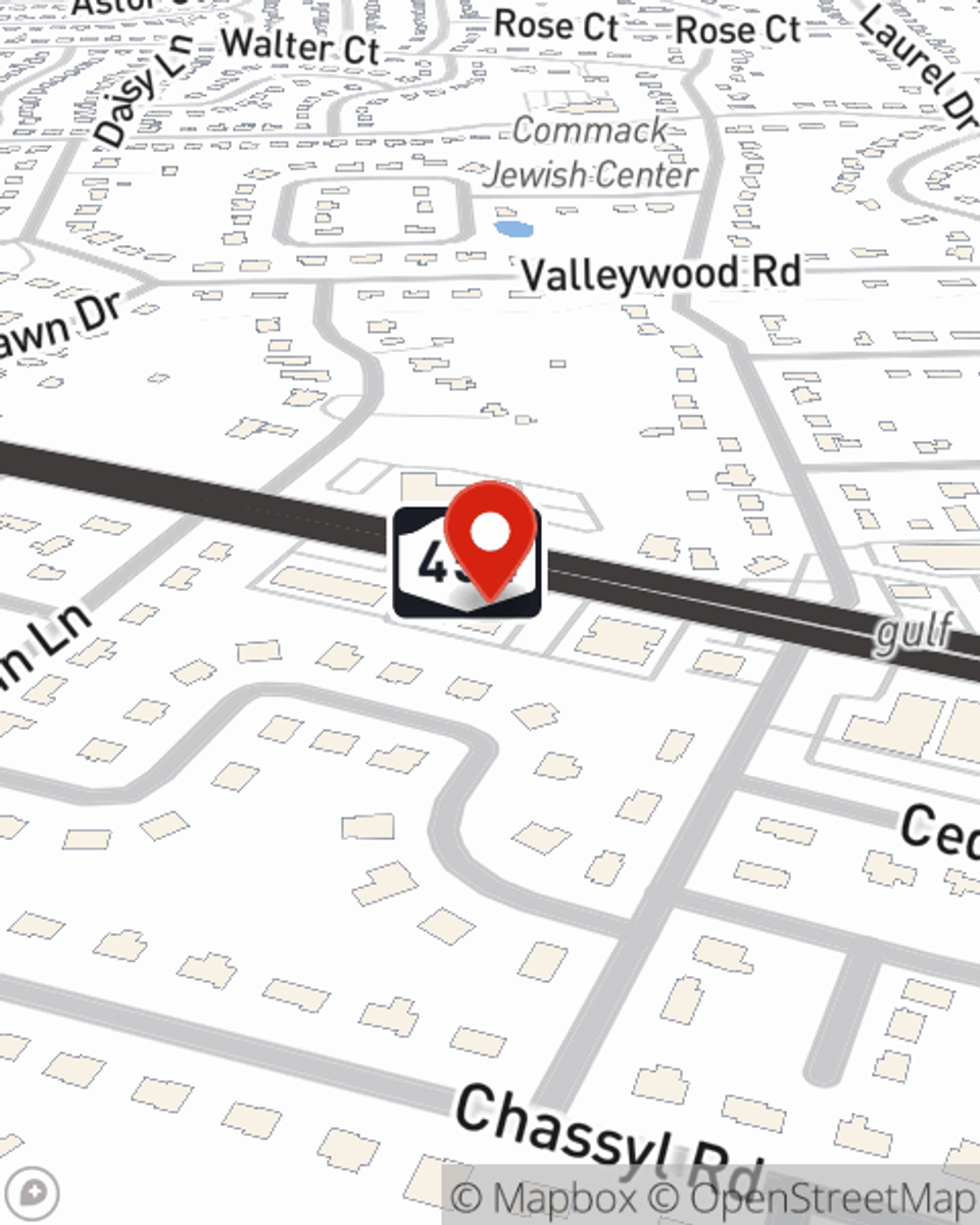

Life Insurance in and around Commack

Insurance that helps life's moments move on

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Babylon

- Bay Shore

- Brentwood

- Central Islip

- Deer Park

- Dix Hills

- East Northport

- Elwood

- Fort Salonga

- Greenlawn

- Hauppauge

- Huntington

- Huntington Station

- Kings Park

- Northport

- Smithtown

- Suffolk County

- Nassau County

- Queens County

- Kings County

- Bronx County

- New York County

- Richmond County

- And in NJ, PA, & CT

Check Out Life Insurance Options With State Farm

When facing the loss of a family member or your partner, grief can be overwhelming. Regular day-to-day life halts as you prepare for funeral services arrange for burial, and try to move forward without your loved one.

Insurance that helps life's moments move on

Don't delay your search for Life insurance

Life Insurance Options To Fit Your Needs

The beneficiary designated in your Life insurance policy can help cover bills and other expenses for your family when you pass away. The death benefit can help with things such as your funeral costs, childcare costs or retirement contributions. With State Farm, you can rely on us to be there when it's needed most, while also providing caring, responsible service.

When you and your family are insured by State Farm, you might rest easy knowing that even if the worst comes to pass, your loved ones may be protected. Call or go online now and discover how State Farm agent Jacquelyn Jacobson can help you protect your future.

Have More Questions About Life Insurance?

Call Jacquelyn at (631) 343-4142 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Jacquelyn Jacobson

State Farm® Insurance AgentSimple Insights®

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.